Maintaining your mortgage can feel like an overwhelming process, but it can also be one of the most rewarding financial milestones of your life. If you’re refinancing for the first time or need a refresh,...

AmeriHome

Insights Blog

Enjoy Helpful Tips And Trends To Keep You and Your Home Healthy And Happy In Every Season.

7 Inspection Red Flags To Look Out For

A home inspection is one of the most important steps in your homebuying journey, helping identify red flags that may require costly repairs or lead to safety concerns. Here’s a breakdown of some warning signs to be...

How To Remove Private Mortgage Insurance And Save Money

Private Mortgage Insurance (PMI) is a common cost for homeowners, but it doesn’t have to be permanent. Here are some ways you can remove PMI payments from your mortgage and save more money sooner than you might...

Real Estate Trends To Watch For In 2026

As we begin another new year, the stage is set for fresh opportunities and emerging trends in the real estate market. From shifting affordability to bold design statements, here’s what to watch for in the year...

6 Holiday Pet Safety Tips To Keep

Your Furry Friends Safe!

The holidays are a time for joy and celebration, but all the fun and festivities can bring some unexpected dangers for your pets. Here are the potential hazards you should know about to keep your furry friends safe...

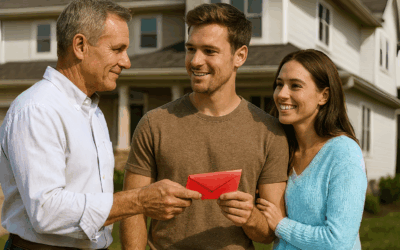

What To Know About Gift Funds

For Your Mortgage

Buying a home is exciting, but coming up with enough money for the down payment can be a hurdle for some borrowers. That’s where help from family or friends can make the dream of homeownership a reality. If you’re...

Top 5 Reasons To Get A Non-QM Loan

If you’re exploring home financing options and find that a traditional mortgage may not be the right fit for you, a Non-QM loan could be a good option. A Non-QM loan is a mortgage that doesn’t fit the traditional...

How A VA IRRRL Helps Veterans

And Service Members

The VA Interest Rate Reduction Refinance Loan (IRRRL), often called the VA Streamline, is designed exclusively for veterans and active-duty service members to make refinancing easier, faster, and more affordable....

5 Fall Pumpkin Recycling Tips!

There are so many great things about the Fall season—Halloween, Thanksgiving, colorful leaves, and cooler temps too. If you also love your pumpkins but are not quite sure of the best way to dispose of them when...

5 Mortgage Myths, Busted!

When you’re buying a home, it can be tough to separate myth from reality. Misconceptions about mortgages can lead to unnecessary stress or missed opportunities. The following are five common mortgage myths that...

Top 4 Benefits Of The Buy Before You Sell Program

For many homeowners, the ability to purchase a new home is often contingent on selling their current one. While some may be comfortable with this traditional approach, selling first and then buying can be a stressful,...

How Buyers Can Properly Negotiate Home Prices

Buying a home is one of the most important financial decisions you’ll make, so it’s important to know exactly how to negotiate the best price possible. Here are some key tips to help you navigate the...

Credit Card Balance Transfers vs. A Cash-Out Refinance: Which Strategy

Works Best?

Many in today’s economic landscape are unfortunately struggling with high-interest credit card debt. Thankfully, there are a couple options (among others) that people can pursue to alleviate the burden – a...

Top 5 Benefits Of A Second Lien Mortgage

A Second Lien Mortgage can be a powerful solution if you are looking to leverage the equity you have built in your home for a low fixed interest rate, without affecting the rate on your first mortgage. This allows you...

How The Federal Reserve Impacts Interest Rates

When it comes to buying a home or refinancing a mortgage, it is crucial to pay attention to interest rates so you can budget accordingly. But what exactly drives those rates up or down? The Federal Reserve plays a...

Subscribe To The

AmeriHome Insights Blog

Sign up to get the latest update from AmeriHome Mortgage

Call Us Now at:

Our Story And Our Purpose

It’s All About You!

Contact your Home Loan Expert to review the financing

options available to you.